When I was 20, I learned a hard lesson about believing in yourself and doubling down.

It was 2011 and I had just moved to SF to integrate myself into the tech world. As such, when I saw an opportunity to win a lunch with Robert Scoble for answering a question on Quora about technology trends, I jumped at the chance.

And, in that answer I wrote in 2011, I talked about something I thought would change the world by 2015: Bitcoin.

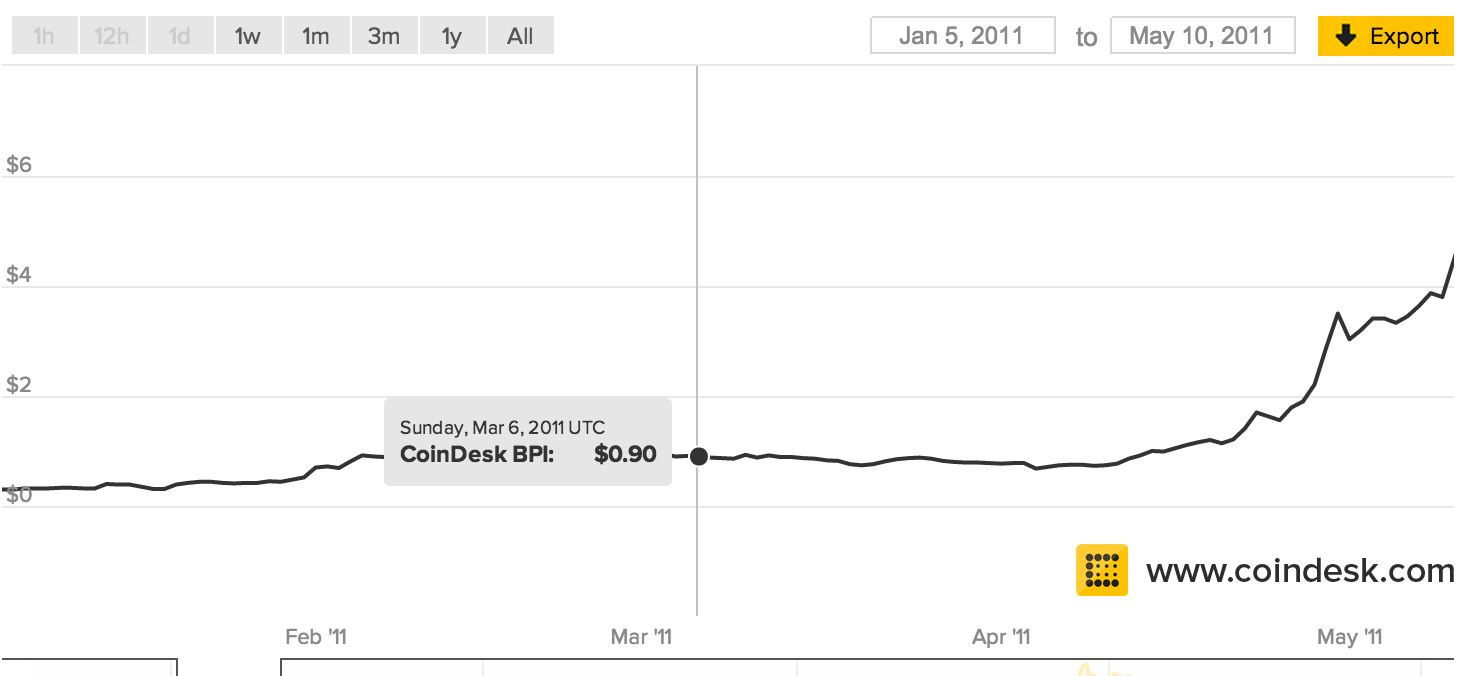

Bitcoin’s price in early 2o11 when I was looking at it:

I thought Bitcoin was going to be huge, had made two friends who were mining and trading the currency, and had some spare cash I should have invested. Yet I didn’t.

Had I bought even $500 worth of Bitcoin (like my friends at the time were) – a currency and a technology I believed in, and truly thought would change the world – today that $500 would be worth roughly $135,000. Had I sold that same $500 near the top of the market in 2013, that $500 would have been nearly $400,000. Ouch.

A Painful Lesson

My failure to capitalize on this opportunity was a huge personal failing. It perfectly exemplifies a principle I’ve only started to internalize in the last few years: that nearly all meaningful gains come from going all in when you think you’re right.

In poker, most of your gains will come from 1–2 hands where you win big pots. Investing in startups? Expect your best investment to be worth more than all others combined (source). Billionaire John Paulson made nearly $5 billion betting everything he had against the 2007 U.S. subprime mortgage lending market. Gains come from doubling down, from being right and having the confidence to follow through.

The reason I didn’t make any money off of Bitcoin is because I didn’t have the conviction to double down. I discovered something I thought was true – that Bitcoin was valuable and would appreciate in value – but didn’t believe in my conviction enough to act.

What did I get from being right? Nothing. You got this blog post.

How I’m Applying This

For talented people there are always tons of opportunities. It’s more important – and in many ways harder – to select the best opportunities than it is to find them in the first place. And yet, this is where gains come from: choosing the best of what’s available to you and then closing off other avenues to focus on that thing.

To use an example I got from my friend Billy Murphy, if your goal was to make a $1000/month business, are you better off getting that $1k by focusing on one business (doubling down) or by running 10 small $100/month businesses?

One business. No question. With 10 small businesses, there’s no chance you’ll invest enough time to deeply understand the market and opportunities available. In an age of the infinite choice offered to us by the internet, most gains go to the very best in a category. When you have options, why would you ever settle for 2nd or 10th best in a category?

This idea of focus, of doubling down, is what I’m building my 2015 around. This time, whenever the next Bitcoin-esque opportunity comes around, I plan to seize it.

Leave a Reply